About the Auditor-Controller

Functions and Responsibilities of the Auditor-Controller

The Auditor-Controller is the chief fiscal officer for the County of Santa Cruz . The Office duties are defined by code sections of the State of California Government Code , Revenue and Taxation Code, Health and Safety Code, Streets and Highways Code, Professions Code, and Education Code. The Office is also subject to federal and state laws, regulations and policies and procedures. The Office adheres to the professional codes and standards defined by various accounting rule setting bodies.

The Auditor-Controller's Office maintains 900 different funds to account for the various monies deposited into the County treasury. These funds represent assets belonging to the County, cities, state and federal agencies, special districts under the Board of Supervisors, autonomous special districts, school districts, and community college. During a fiscal year, the Office will receive 3/4 of a billion dollars and disburse a similar amount on behalf of the depositors issuing more than 300,000 checks.

The Auditor-Controller is responsible for the following specific duties:

- Accounting systems administration, development, and oversight.

- Budgetary control over all funds within the treasury.

- Payroll administration for more than 3,000 County and district employees.

- Property tax administration and Distribution of over $250 million from secured and unsecured property.

- General accounting and financial reporting.

- Preparation of County's final budget, annual financial statements, countywide cost allocation plan and tax rate calculations.

- Auditing and processing of vendor claims against the County.

- Conduct professional internal and external compliance and performance audits.

- Cash management, treasury auditing, short-term borrowing, and debt service management.

- Preparation of various financial reports required by the school districts, special districts, redevelopment agencies, the County and the State.

The Office of Auditor-Controller has consistently received:

- The Certificate of Excellence in Financial Reporting Awarded by the Government Finance Officers Association.

- Unqualified audit opinions from independent auditors.

- Good internal audit quality assurance reviews.

- Good compliance audit reports on property tax administration.

The Auditor-Controller serves citizens, elected officials, county departments, special districts, schools, state and federal departments, employees, unions, banks, vendors, certified public accountants, consultants, bond rating agencies, investors and the grand jury.

History of the Office of Auditor-Controller

The office was established in 1850. There has been an elected Auditor-Controller in Santa Cruz County since that time.

| Peter Tracy |

1850-1855 |

| I. C. Wilson |

1856-1857 |

| J. F. J Bennett |

1858-1859 |

| D. J. Haslam |

1860-1865 |

| T. T. Tidball |

1866-1867 |

| H. H. Hobbs |

1868-1869 |

| Albert Brown |

1870-1873 |

| H. E. Makinney |

1874-1879 |

| Ed Martin |

1884-1902 |

| Willit Ware |

1903-1946 |

| George S. Kriz |

1947-1970 |

| Arthur Q. Merrill |

1971-1985 |

| Gary A. Knutson |

1986-2005 |

| Mary Jo Walker |

2006-2015 |

| Edith Driscoll |

2015-present |

Vision Statement

To efficiently provide residents, businesses, employees and other interested parties with quality services using current best practices, professional standards, innovative ideas, and proven technology.

Primary Duties

Audit and approve claims against the county Treasury including:

- Vendor claims for services

- Payroll

- Tax refunds

- Trust claims

- Other claims and judgments

- Vendor claims for services

Accounting systems development and oversight

- General ledger and subsystems

- Payroll system

- Property tax system

Payroll

- 3,000 County and Autonomous Special District employees

- Tax, insurance and retirement processing and reporting

Cash and Debt Management

- Treasury oversight

- Working capital borrowing

Budgetary Oversight

- Preparation of Final County Budget

- County Funds

- Board Governed Special Districts

- Autonomous Special Districts

Property Tax Administration

- Computing the property tax distribution to all taxing agencies (cities, schools and special districts)

- Setting tax rates and extending the tax roll for the tax collector

- Accounting for taxes and assessments

Internal and External Audits

- Financial

- Compliance

- Performance

- Fraud

- Special review

General Accounting

- General ledger activity

- Interest apportionment

- Bond and long term debt

- State mandated claims

- Fixed assets

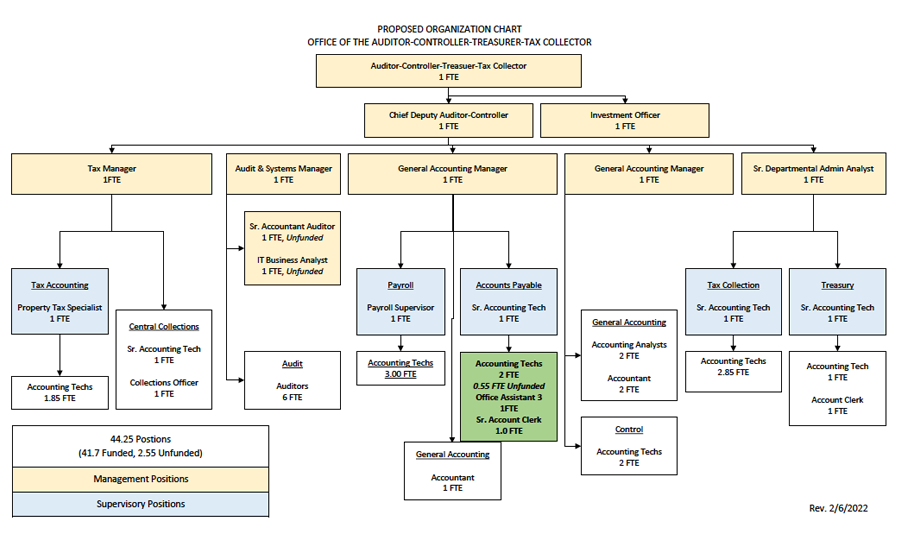

Organization Chart of the Auditor Controller's Office

Click the image to view full size